Raise Your Experience with Bagley Risk Management

Raise Your Experience with Bagley Risk Management

Blog Article

Recognizing Livestock Risk Security (LRP) Insurance Coverage: A Comprehensive Guide

Navigating the realm of animals danger defense (LRP) insurance coverage can be a complex venture for many in the agricultural market. This sort of insurance coverage uses a safeguard versus market variations and unexpected conditions that can impact livestock producers. By recognizing the complexities of LRP insurance policy, producers can make enlightened decisions that may safeguard their procedures from economic risks. From exactly how LRP insurance policy functions to the different insurance coverage options offered, there is much to discover in this thorough guide that could potentially shape the method animals producers approach risk administration in their businesses.

Just How LRP Insurance Coverage Functions

Sometimes, comprehending the mechanics of Livestock Risk Protection (LRP) insurance policy can be complicated, yet damaging down how it functions can give clarity for farmers and ranchers. LRP insurance is a danger management device developed to secure animals manufacturers versus unexpected price decreases. It's crucial to keep in mind that LRP insurance is not a profits assurance; rather, it focuses exclusively on cost risk protection.

Eligibility and Coverage Options

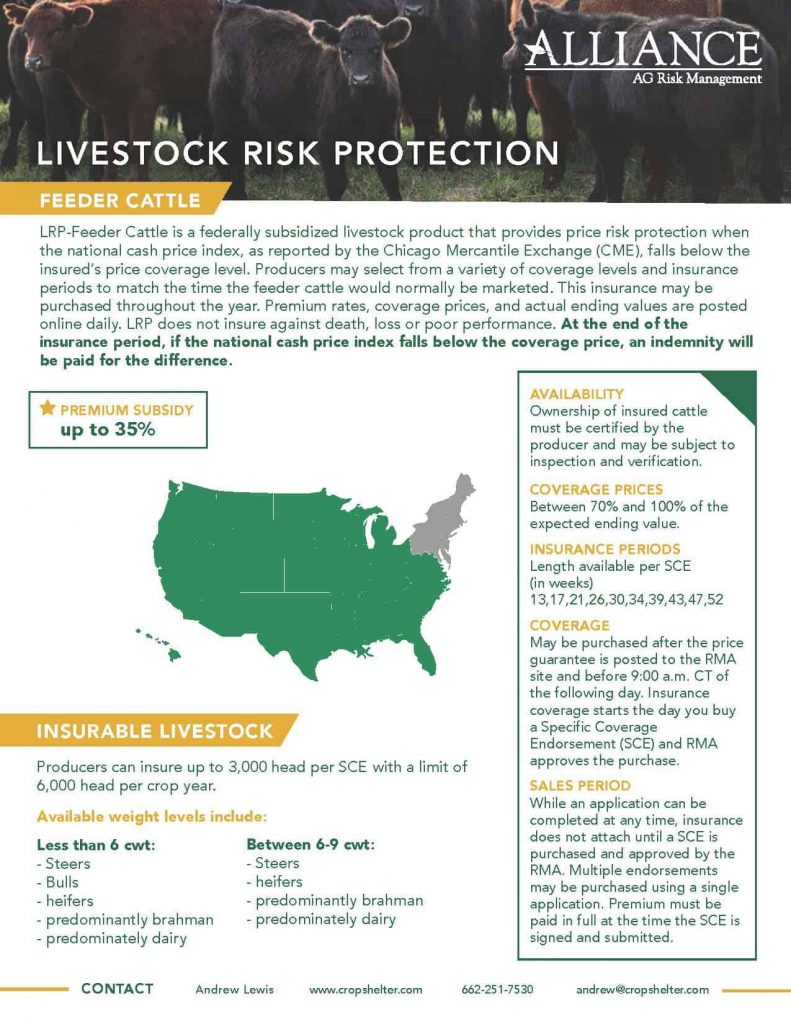

When it comes to coverage options, LRP insurance coverage supplies producers the flexibility to select the insurance coverage level, coverage duration, and recommendations that ideal match their threat management requirements. Protection degrees normally range from 70% to 100% of the anticipated finishing worth of the insured livestock. Producers can likewise choose protection periods that line up with their manufacturing cycle, whether they are guaranteeing feeder cattle, fed cattle, swine, or lamb. Endorsements such as rate danger defense can better tailor insurance coverage to shield versus unfavorable market changes. By comprehending the qualification requirements and protection options offered, livestock manufacturers can make enlightened decisions to manage threat efficiently.

Pros and Disadvantages of LRP Insurance Policy

When reviewing Animals Threat Defense (LRP) insurance coverage, it is vital for livestock producers to consider the downsides and advantages fundamental in this danger administration device.

One of the primary benefits of LRP insurance coverage is its ability to offer protection against a decrease in animals prices. In addition, LRP insurance policy supplies a degree of versatility, enabling manufacturers to customize insurance coverage degrees and plan durations to match their particular needs.

One limitation of LRP insurance coverage is that it does not safeguard versus all kinds of dangers, such as condition break outs or all-natural catastrophes. It is essential for producers to meticulously evaluate their specific risk exposure and financial circumstance to determine if LRP insurance is the ideal danger administration device for their procedure.

Understanding LRP Insurance Premiums

Tips for Making Best Use Of LRP Advantages

Taking full advantage of the benefits of Livestock Threat Defense (LRP) insurance calls for tactical planning and aggressive threat management - Bagley Risk Management. To maximize your LRP coverage, think about the adhering to pointers:

Routinely Analyze Market Problems: Keep educated concerning market fads and cost changes in the livestock sector. By checking these elements, you can make informed decisions about when to acquire LRP coverage to shield versus prospective losses.

Set Realistic Protection Levels: When selecting insurance coverage degrees, consider your production costs, market price of animals, and possible risks - Bagley Risk Management. Establishing reasonable insurance coverage levels ensures that you are appropriately protected without overpaying for unneeded insurance policy

Expand Your Protection: As opposed to counting solely on LRP insurance coverage, consider diversifying your risk administration methods. Integrating LRP with other danger administration tools such as futures contracts or options can supply detailed coverage against market unpredictabilities.

Testimonial and Readjust Insurance Coverage Frequently: As market problems alter, periodically evaluate your LRP coverage to guarantee it straightens with your current threat exposure. Readjusting coverage degrees and timing of acquisitions can assist enhance your danger defense approach. By following these tips, you can make best use of the benefits of LRP insurance and guard your animals operation against unpredicted threats.

Conclusion

In final thought, animals threat protection (LRP) insurance policy is a valuable tool for farmers to take care of the economic dangers connected with their animals operations. By understanding exactly how LRP works, eligibility and protection choices, in addition to the advantages and go to my site disadvantages of this insurance, farmers can make enlightened decisions to shield their livelihoods. By thoroughly webpage considering LRP costs and executing strategies to optimize benefits, farmers can mitigate possible losses and make certain the sustainability of their operations.

Livestock producers interested in acquiring Animals Threat Protection (LRP) insurance coverage can explore a range of qualification requirements and protection choices customized to their certain animals procedures.When it comes to protection choices, LRP insurance policy offers manufacturers the adaptability to pick the protection degree, insurance coverage period, and endorsements that ideal suit their danger administration needs.To grasp the complexities of Livestock Risk Protection (LRP) insurance totally, understanding the variables influencing LRP insurance premiums is crucial. LRP insurance policy premiums are determined by numerous components, consisting of the coverage degree picked, the expected cost of animals at the end of the coverage period, the type of livestock being guaranteed, and the length of the coverage period.Testimonial and Readjust Insurance Coverage Consistently: As market problems transform, periodically review your LRP insurance coverage to ensure it aligns with your existing threat direct exposure.

Report this page